Best Ways for Sending Money from the UK to Pakistan

Sending money from the UK to Pakistan is a crucial task for many, whether it's supporting family, managing property, or covering day-to-day expenses. With various remittance options available, it's essential to choose a service that offers security, affordability, and speed. This guide covers the most popular remittance services, breaking down their benefits and what to consider when sending money from the UK to Pakistan.

Understanding Remittance Options: Digital vs. Cash

When sending money to Pakistan, you have two primary methods: digital transfers or carrying cash for local exchange. While the idea of carrying cash and exchanging it locally might seem appealing due to potentially better rates, this approach carries significant risks, such as safety concerns and the logistical hassle of finding trustworthy exchanges. Digital transfers, on the other hand, offer security, convenience, and transparency, making them the preferred choice for many.

Top Remittance Services for Sending Money from the UK to Pakistan

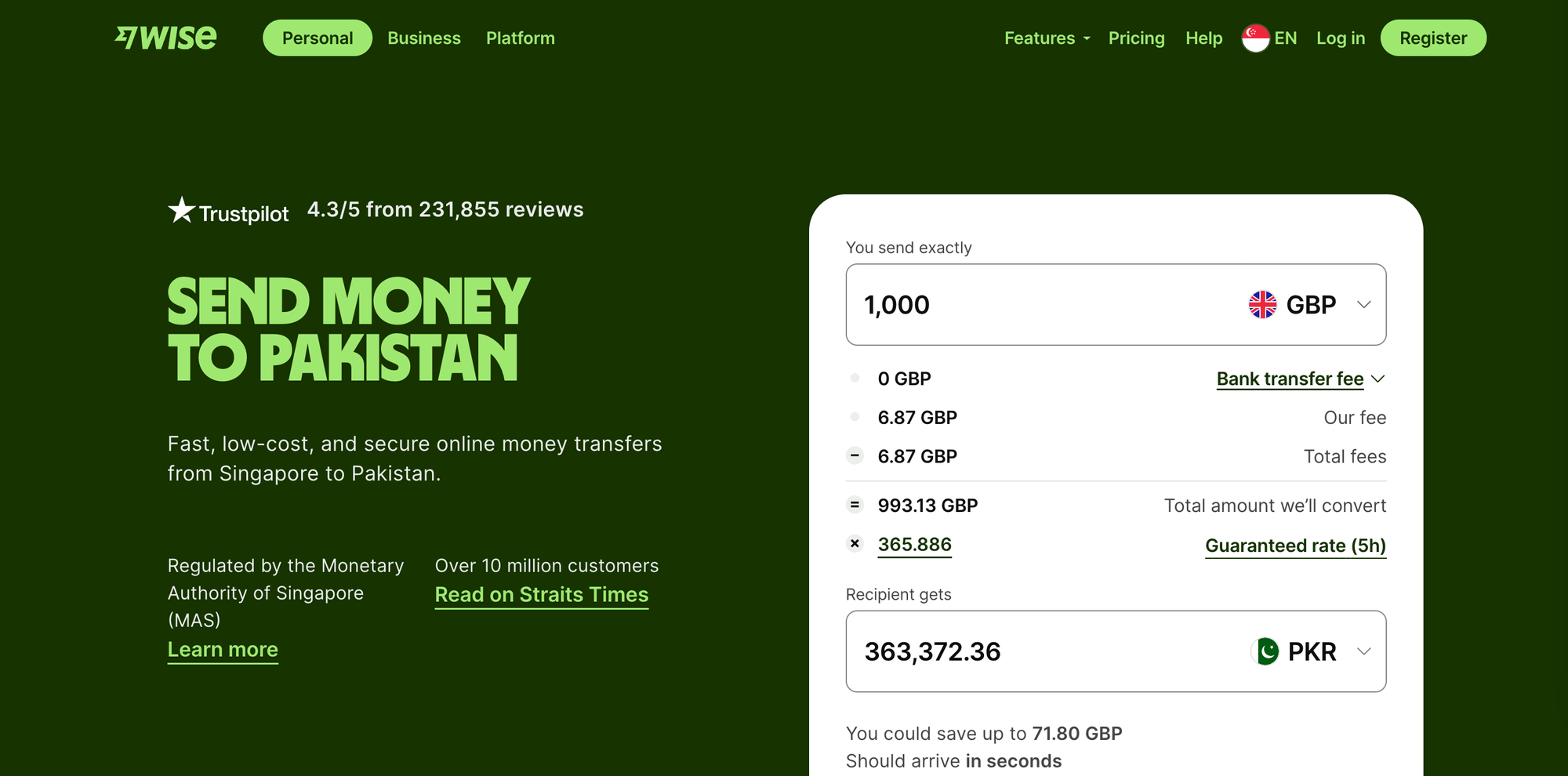

1. Wise: Save When You Send Money to Pakistan

Wise (formerly TransferWise) is renowned for its transparency and fairness. Unlike traditional banks that often hide fees within exchange rates, Wise uses the mid-market rate, ensuring you get the best possible value. All fees are displayed upfront, so there are no surprises. Whether you’re sending money to support your family or making a business payment, Wise ensures you get the most out of your transfer.

2. Western Union: Global Reach with Local Convenience

Western Union provides a versatile range of options for sending money to Pakistan. You can transfer money online, via their app, or in-person at a Western Union location. They offer cash pickups, direct bank deposits, and even door-to-door delivery in certain areas. Security is a priority, with each transaction encrypted and trackable using the provided MTCN (Money Transfer Control Number). With a vast network across Pakistan, Western Union ensures your money reaches its destination quickly.

Learn more about Western Union

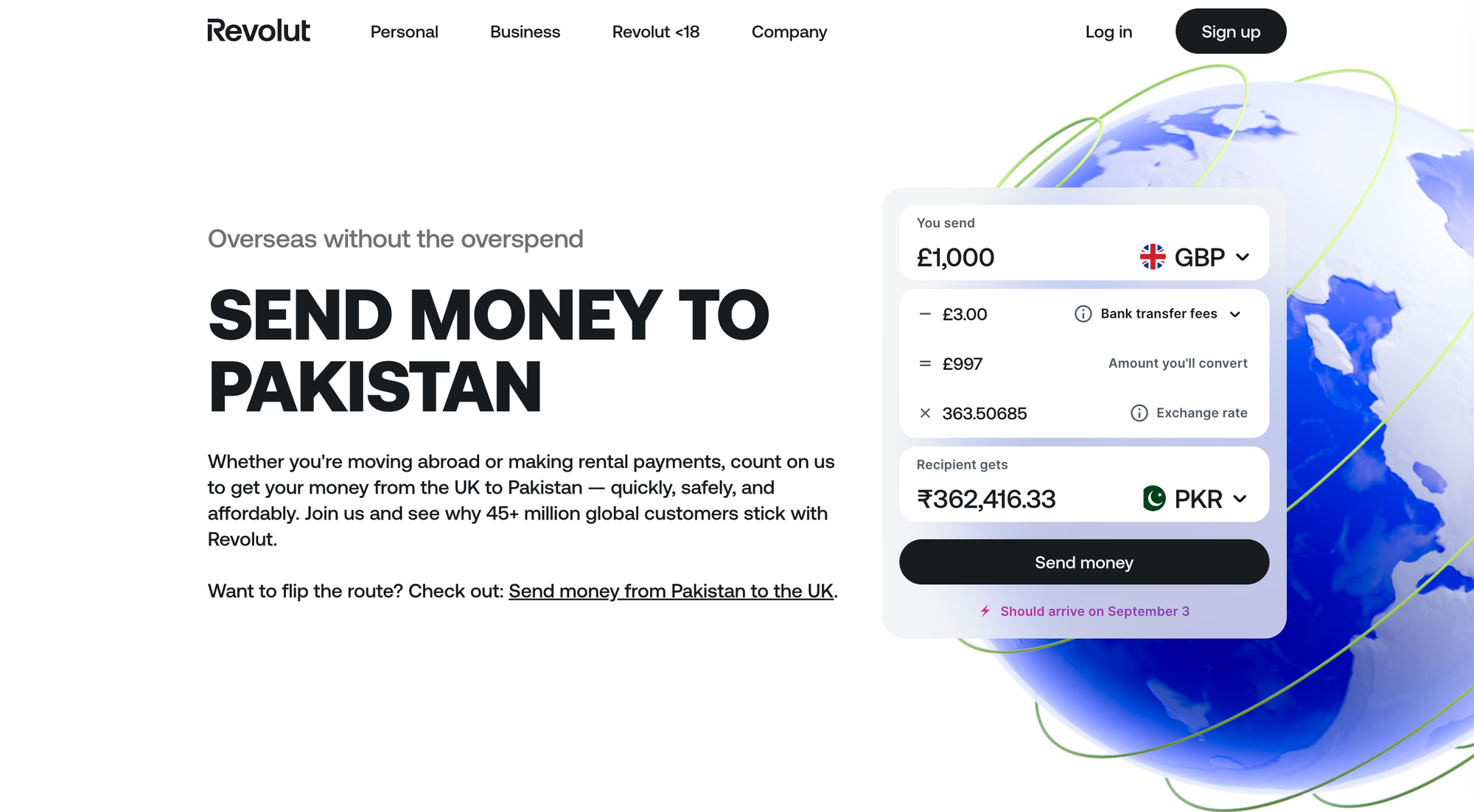

3. Revolut: Overseas Without the Overspend

Revolut has become a popular choice for international money transfers, including to Pakistan. Whether you’re handling regular payments or one-off transfers, Revolut offers competitive exchange rates and low fees. Their user-friendly app simplifies the transfer process, making it quick, safe, and secure. With over 45 million global customers, Revolut is a trusted name for sending money from the UK to Pakistan.

4. Ria: Fast, Flexible, and Secure

Ria boasts a worldwide network of over 507,000 locations in 160 countries, making it one of the most extensive money transfer services globally. When sending money to Pakistan, Ria’s speed, flexibility, and security are major advantages. They also offer additional services such as bill payment and mobile top-ups, which can be very convenient for recipients. Ria is committed to providing a seamless transfer experience every time.

5. Remitly: Instant Transfers at Your Fingertips

Remitly is highly regarded for its efficiency and speed. The service offers instant transfers at competitive rates, with various options for delivery, including direct bank deposits and cash pickups. Remitly is transparent about fees and exchange rates, and their easy-to-use app has made them a favourite for those needing quick and reliable transfers to Pakistan.

Exchange Rate Considerations

When sending money from the UK to Pakistan, some might consider sending funds in GBP or USD and exchanging it locally for PKR to potentially get better rates. However, the risks associated with carrying large sums of cash are significant, including safety concerns and the challenge of finding an exchange that offers competitive rates without added hassle.

User Experiences and Recommendations

Many users have found that digital remittance services like Wise or Remitly offer better overall value and security compared to carrying cash. Testimonials reveal that the small margin gained by exchanging cash locally often isn't worth the associated risks and inconvenience. Direct bank transfers, available through most of the services mentioned, provide a safer and more hassle-free way to send money from the UK to Pakistan.

Legal and Security Concerns

Carrying large amounts of cash across borders can have legal implications and exposes you to considerable risk, especially given Pakistan's current law and order situation. Digital transfers are not only more secure but also ensure compliance with international and local regulations, offering peace of mind to both the sender and the recipient.

Conclusion: Finding the Right Service for Sending Money from the UK to Pakistan

Each remittance service offers unique benefits, whether you prioritise speed, cost, or convenience. When choosing the best option for sending money from the UK to Pakistan, consider your specific needs and compare the exchange rates, fees, and transfer times. With the right choice, you can ensure your money reaches its destination safely and efficiently.

Additional Tips

- Stay updated on the latest exchange rates and remittance service offerings.

- Consider the recipient's location and accessibility to cash pickup locations or bank branches.

- Use services that offer transparency in fees and exchange rates to avoid hidden costs.

FAQs

1. What is the best way to send money from the UK to Pakistan?

- The best way depends on your priorities—whether it's speed, cost, or convenience. Services like Wise and Remitly are popular for their transparency and competitive rates, while Western Union is known for its extensive network and versatility.

2. Is it safe to carry cash when sending money from the UK to Pakistan?

- Carrying large amounts of cash is risky due to safety concerns and legal implications. It is generally safer to use digital remittance services, which offer secure and trackable transactions.

3. How do exchange rates affect sending money from the UK to Pakistan?

- Exchange rates can significantly impact the amount of money your recipient receives. Services like Wise use the mid-market rate, which is often the most favourable, while others may include a markup in the exchange rate.

4. Can I send money directly to a bank account in Pakistan?

- Yes, most remittance services like Wise, Remitly, and Western Union allow you to send money directly to a bank account in Pakistan.

5. Are there any hidden fees when sending money from the UK to Pakistan?

- Some services may have hidden fees, especially if they offer "no fee" transfers but apply a less favourable exchange rate. It's important to choose a service that is transparent about all costs, like Wise or Remitly.